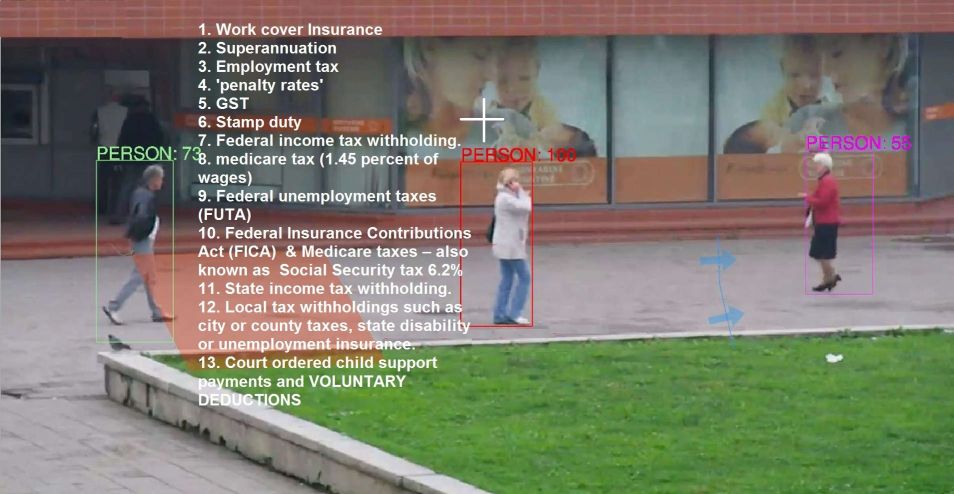

Examples of VOLUNTARY DEDUCTIONS are group life insurance, healthcare and/or other benefit deductions, Credit Union deductions, etc. Additionally, voluntary deductions can be taken out of an employee's gross pay as a pre-tax deduction, a tax deferred deduction, or a post-tax deduction.

As if this wasn't complicated enough Now do you see why employers large and small are tearing their hair out trying to keep up with all this bureaucracy ( on top of paying the current Stamp Duty yes Stamp Duty and GST) not just income tax!?

It is time for Genuine Tax Reform which MIKE JESSOP Independent WHIG PARTY will implement forthwith

There is sufficient education and control for employees to choose and take care of their own payments entirely out of the savings from having a GGST ( please see Issue 40)

Please vote the present incumbents out of office at the next election

Yours sincerely

MIKE JESSOP

REVOLUTIONARY WHIG PARTY

Together we will change the course of history

May God bless you

Leave your comments below and hit the subscribe button on youtube

Hit the share button and like us on Facebook

With apologies to LONDON and his mate CHARIVARI

Tel: 07 5499 6937

Ph: 0416 293 686

Contact Mike